How long will COVID-19’s impact be felt?

Much like the sentiment felt among European consumers, many North Americans expect the impact of the novel coronavirus (COVID-19) to last for quite some time. That means the inordinate rise of in-home food and beverage consumption we’ve seen this year will likely continue for the foreseeable future. While the health and immune-boosting properties of fresh produce have brought growth to the category, many consumers have sought frozen and pantry-friendly fruits and vegetables much more than they did before the outbreak.

But many pre-outbreak behaviors and tendencies will likely stay in the rear view mirror, as communities hunker down at home in efforts to mitigate further spread of COVID-19. Overall, it’s left many consumers fearful that the worst is yet to come in terms of further localized virus impact. In fact, a new NielsenIQ survey of consumers from over 70 countries shows that 79% of Canadians and 71% of Americans expect the spread and intensity of local COVID-19 impact in their country to increase.

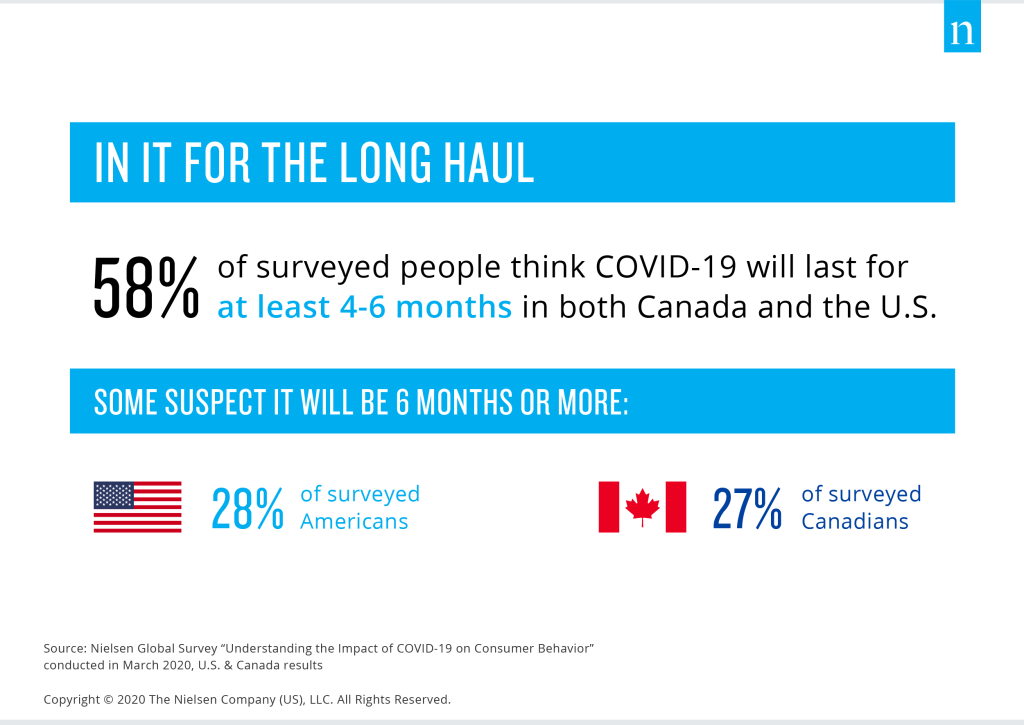

Extensions and new inclusions have been made to many government-mandated social distancing policies, and not surprisingly, a majority of surveyed North Americans indicate they expect the impact of COVID-19 will persist for months, not just weeks. With no end in sight, 58% of North Americans expect the impact of COVID-19 will last for at least four to six months. Nearly 30% of those consumers, both in Canada and the U.S., are even less optimistic, and expect the impact to last for six months or more in either country.

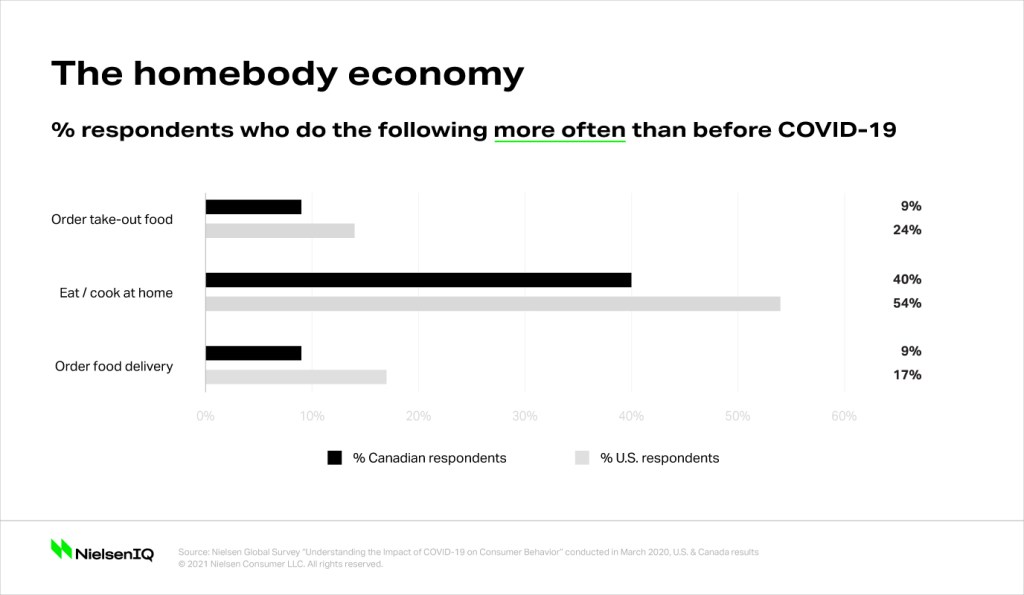

Knowing that consumers from both countries are well within the behavioral threshold of restricted living, it is to be expected that cooking and eating at home have become increasingly more popular. In fact, four in ten Canadians and five in ten Americans indicate that they cook or eat at home more often now than before the COVID-19 outbreak.

Consumers are solving for gaps in access to products and services

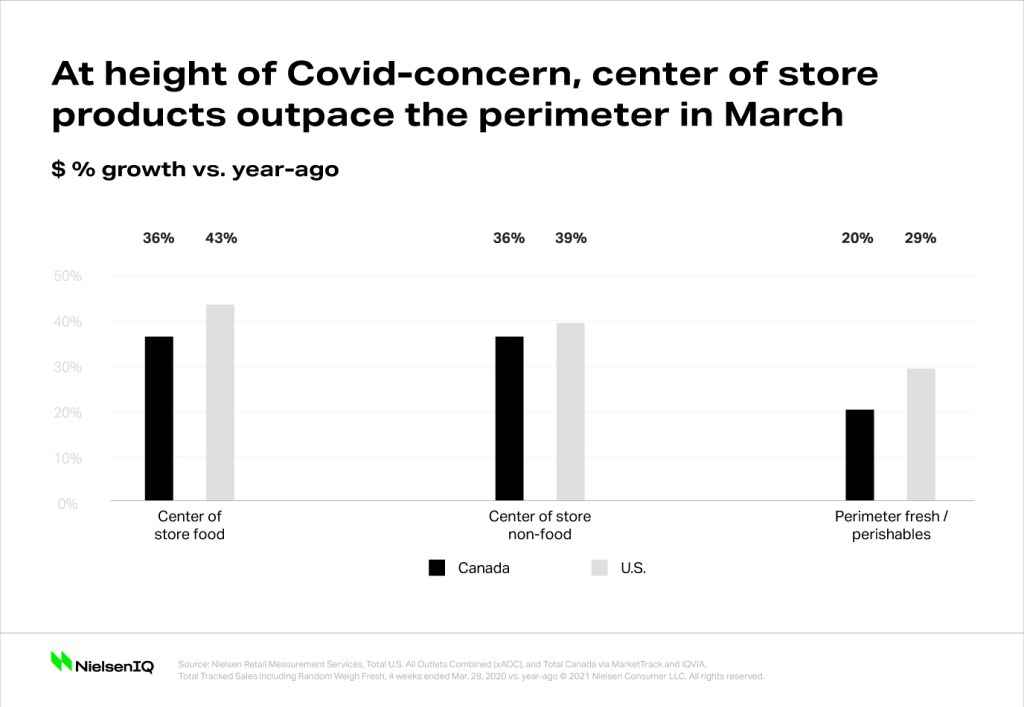

From baking to beauty care and all the meal preparations and self-care in between, consumers are trying many ways to solve for gaps in the products and services they now have limited—or no—access to. As a result of the increased product needs at home, sales of consumer packaged goods (CPG) this year have swiftly exceeded the norm from years prior. In the year-to-date period ended March 28, total CPG sales were up nearly $2.7 billion in Canada and $23.7 billion in the U.S. compared with a year ago. For both countries, this year-to-date growth is higher than the CPG sales growth witnessed across the entire 2019 calendar year. Fresh products typically found within the store perimeter have benefited from some of this growth, but sales spikes were much less pronounced than in center-of-store foods and household essentials.

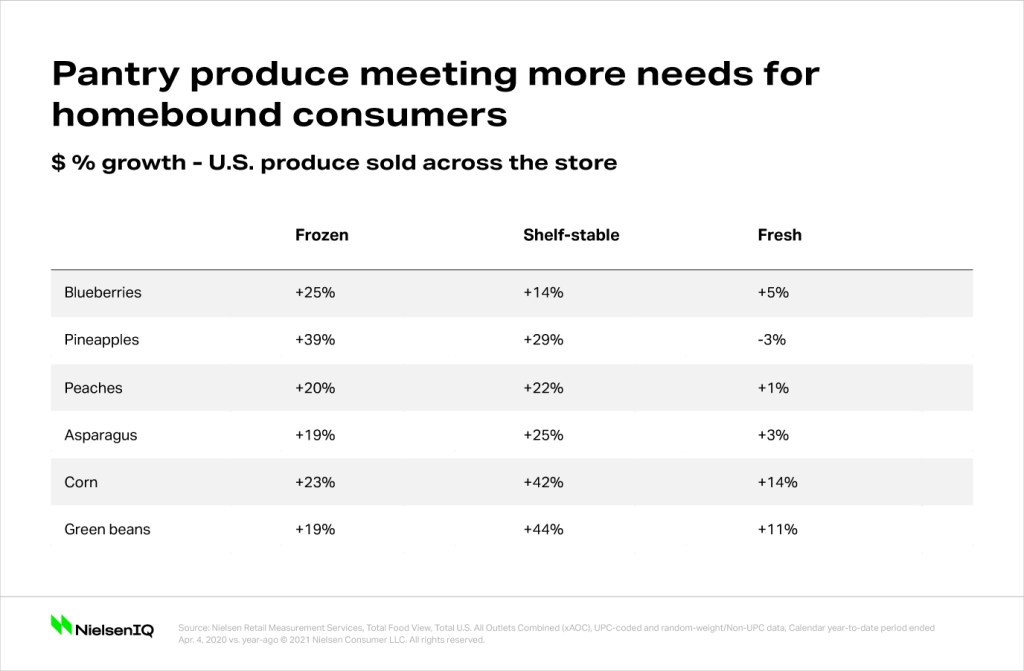

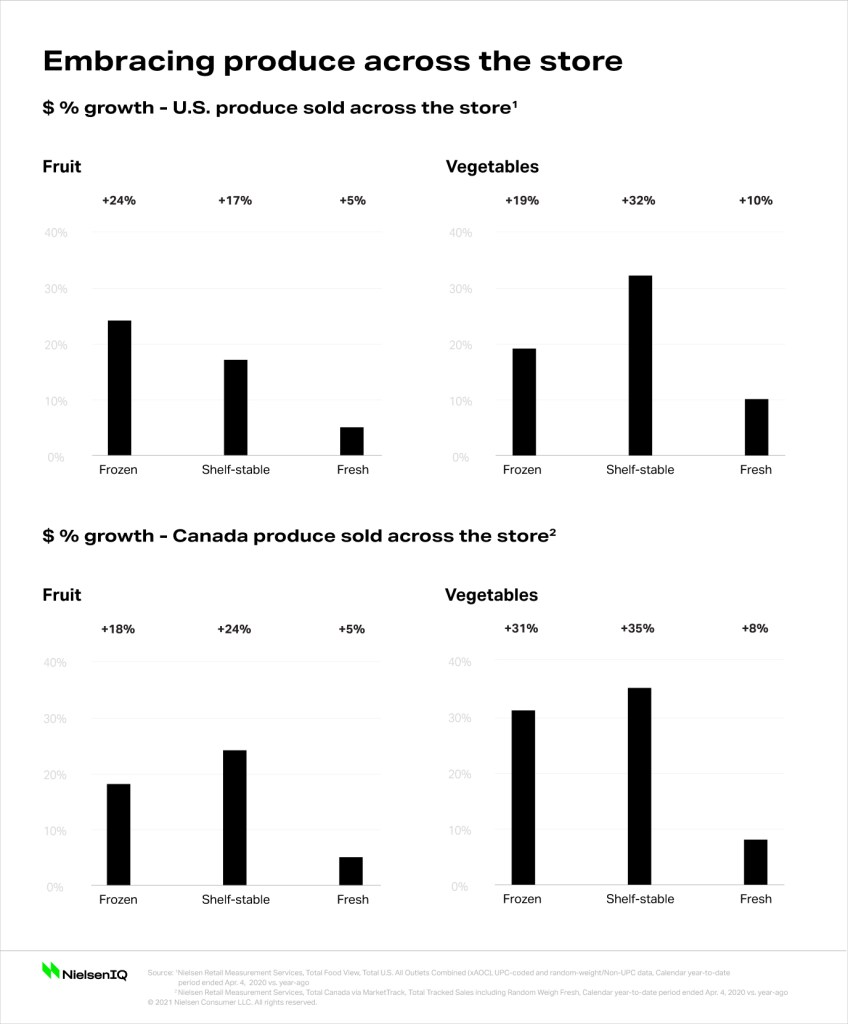

Consumers are still actively buying fresh foods, but they’re also prioritizing the purchase of healthful foods that come with the added benefit of an extended shelf life. Produce is one example of a health-oriented category for which consumers are actively buying canned, bottled, or frozen variants found across the store. In both Canada and the U.S., purchases of frozen and shelf-stable fruit grew at three to five times the rate of fresh fruit in the year-to-date period ended April 4.

New goals for producers of fresh, frozen, and shelf-stable produce

The impact of restricted living has extended well beyond early pandemic planning. North Americans have continued to pad their pantries with frozen and shelf-stable produce more than we’ve seen in years prior. Fresh pineapple sales in the U.S., for example, are down 3% so far this year, while frozen and shelf-stable pineapple sales are up 39% and 29%, respectively. For companies that play in the space of frozen and shelf-stable produce, it’s important to provide consumers with continued guidance and inspiration into ways to use these products they have recently stocked up on. Reminding and encouraging the regular use of the produce they’ve stored will be essential to maintaining growth even beyond COVID-19 impact. Companies must transform the trial that has taken place in this time of emergency into longer-term habits and use cases for canned or frozen goods.

On the other hand, producers of fresh produce will need to remain aligned with the potential rising demand for products of local origin. For at least 15% of surveyed Americans and 14% of surveyed Canadians, buying local products (products from within Canada or the U.S.) has been something they’ve actively done more often than before COVID-19. The more that growers and suppliers of produce can promote the specifics of which country, state, and even farm or neighborhood their product originates from, the more they can provide complete transparency to consumers who may fear the risks associated with products that have had too many global touchpoints.