Welcome to the pet-lover’s paradox: in a world of tightening purse strings, our furry companions seem to be getting the royal treatment! NIQ’s Pet team has dived deep into the heart of this delightful mystery, just in time for National Pet Day. As we explore how consumers are pampering their pets amidst budget constraints, get ready for an exploration of love, loyalty, and lavish treats!

The State of Pet

Pet Care has continued to see growth, even during times of constrained wallets. In 2023, Pet Care outpaced the rest of store departments in terms of dollar growth, both online (+13.4%) and in-store (+5.0%).1

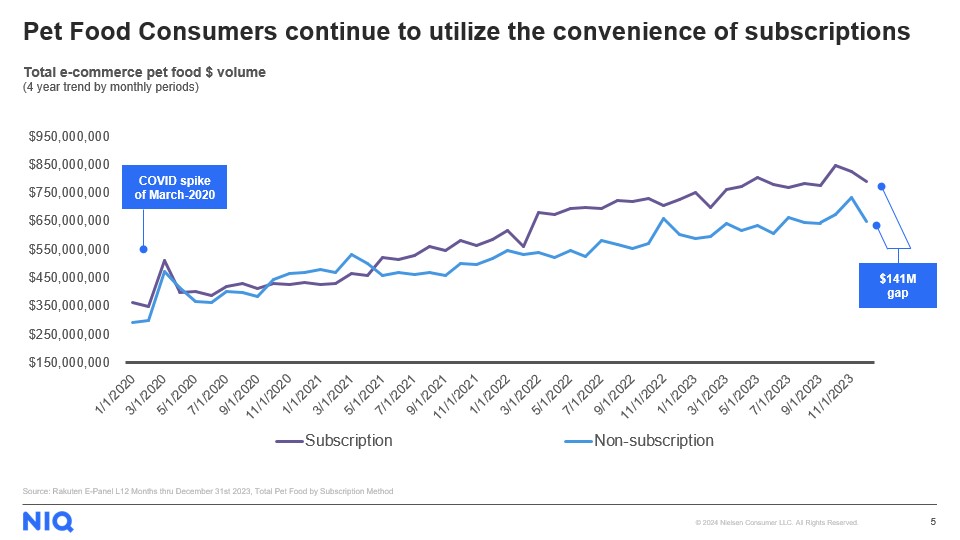

As online purchasing becomes more prevalent—taking up 39% of total Pet Care sales—the percent of buyers and dollars happening exclusively online saw increases, while the percent of buyers and dollars happening exclusively in-store saw declines.2

With this, almost 80% of all dollars spent in Pet Care are by shoppers using both brick & mortar and “.com” options, with online growing share due to continued use of subscription-based purchasing.3

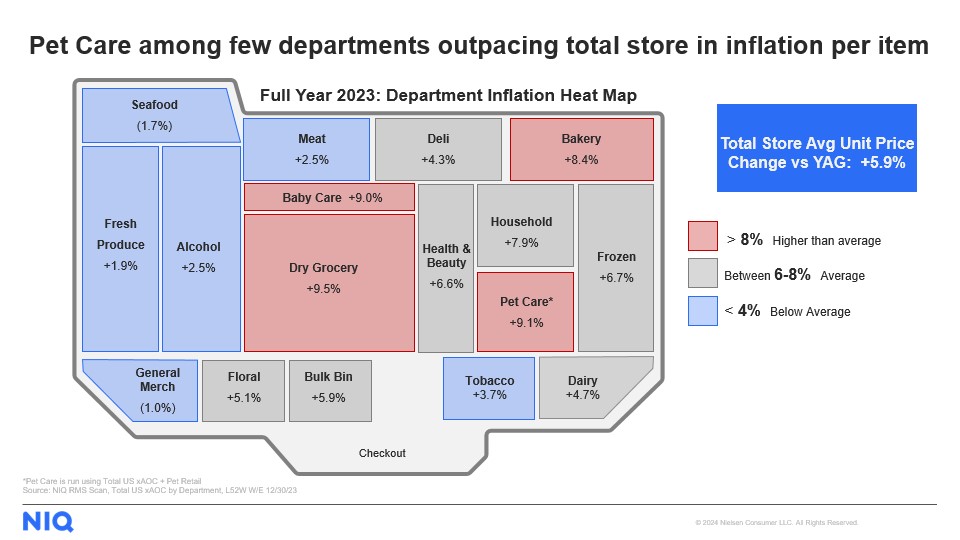

Inflation

As inflation has creeped up in all areas of the store in the past few years, Pet Care was among few departments outpacing total store in inflation per item. As of February 2024, average unit prices in the Pet Care department were over 9% higher than they were the previous year.4

Private Label

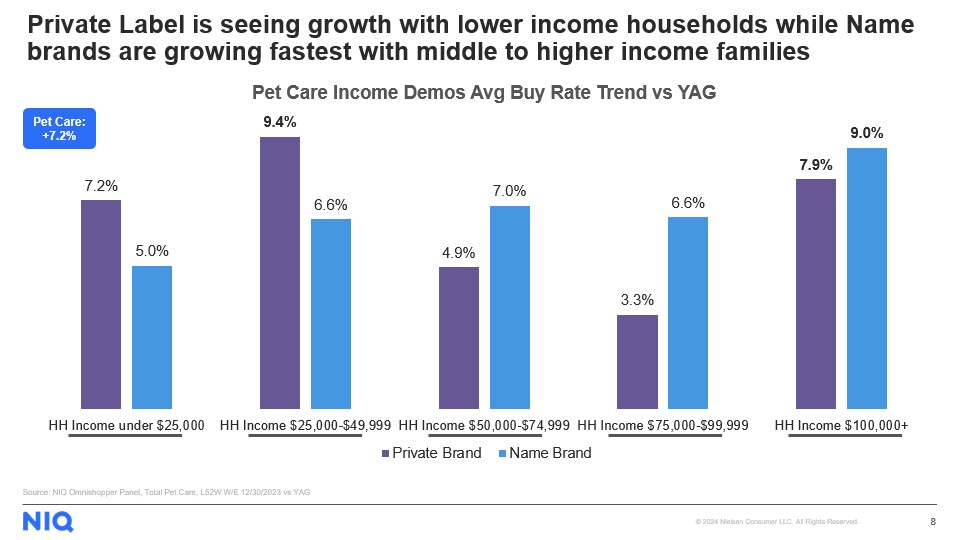

As budgets get tighter, private label brands have become more prevalent. Across the store, private labels’ share of wallet and basket has been increasing, with 19.5% of dollar share and 21.6% of unit share.3 For Pet, private label hasn’t seen change in dollar or unit share against name brands, with private label making up 17% of dollar share and unit share in 2023. With this, poundage has shifted from 1/5th 2020 to over 1/4th in 2023.4

Though private label takes up less dollar share and unit share compared to name brands, a vast majority (73%) of consumers are buying both. In addition, private label is being purchased by a wide variety of consumers, but is most popular with those whose household income ranges from 25K to 50K, and those aged 65-79.5

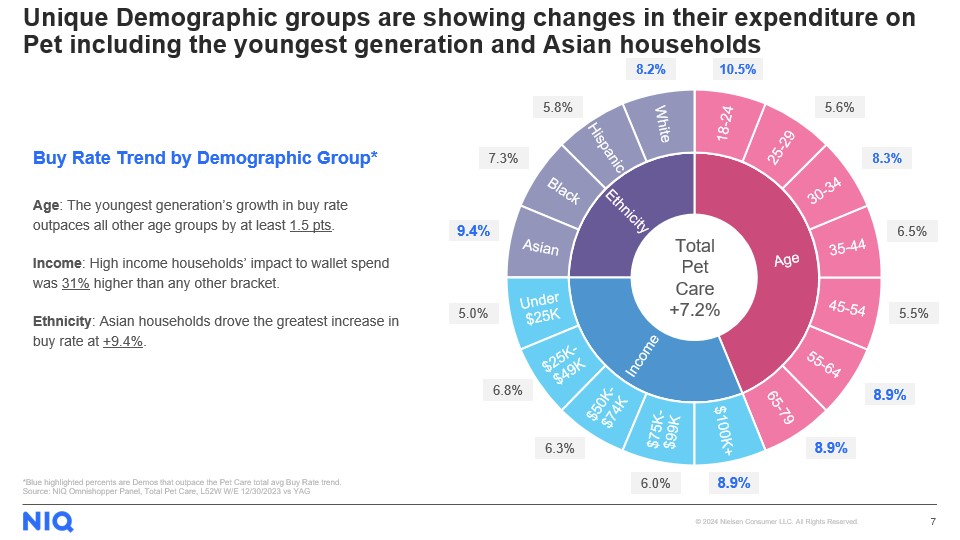

Top Consumers

No matter your age or your income, consumers want to spoil their pets when they can. With that, certain demographics are seeing some substantial growth. Gen Z and Asian households are outpacing others with a +10.5 and +9.4% buy rate, respectively.3 As pet ownership becomes increasingly intertwined with lifestyle choices and cultural norms, these demographics are emerging as key players in the pet products market, indicating a shifting landscape of pet care preferences and spending habits.

What’s Ahead

As we celebrate National Pet Day and beyond, the pet industry is poised for continued growth and innovation, fueled by consumer demand for products and services that cater to the well-being and happiness of their furry companions. By staying attuned to emerging trends and demographic shifts, businesses can position themselves to thrive in this ever-evolving landscape of pet care.

- NIQ Omnisales Measurement; 52 WE 12/30/2023 vs LY

- NIQ Omnisales; Total Omni, L52W W/E 12/30/23 vs YAG

- NIQ Omnishopper Panel, Total Pet Care, L52W W/E 12/31/2023 vs. YAG

- NIQ RMS Scan, Total US xAOC by Department, L52W W/E 12/30/23, Pet Care using Total US xAOC + Pet Retail

- NIQ Omnishopper Panel, Total Pet Care, L52W W/E 12/30/2023 vs 2 YAG